Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsNews

Like Santa’s elves, California almond handlers were busy in December, shipping a record 204.6 million lbs. Even Amazon would be impressed by the holiday activity, which eclipsed last December shipments of 156.2 million lbs by 31%. Export shipments accounted for most of the gain with China (up 16.7 million lbs) and India (up 14.3 million lbs) comparing well versus lackluster activity in December a year ago. Domestic (USA) shipments at 53.0 million lbs were up a solid 7.7%.

Season-to-date shipments at 1038 million lbs have now pulled ahead of last season by a respectable 9.2%. This is remarkable improvement from the end October snapshot when cumulative shipments were slightly behind the pace set in the prior season.

Strong sales in December also added to the healthy picture of robust demand. Commitments are reported to have dropped by only 39 million lbs to 621 million lbs, inferring new sales (commitments) in December of 166 million lbs – another record.

Before calculating the sold and shipped percentage, lets revisit the 2017 crop number in light of December receipts of 214 million lbs for cumulative season tally of 2208 million lbs. This compares to December receipts of 132 million lbs a year ago and a total of 2061 million. So hullers slowed down in December, but not by as much as last year. Last season, after December, an additional 74 million lbs were reported for final crop of 2136 million. It’s a reasonable guess that this year there might be a little more still to come. For now we are going to peg the 2017 crop at 2300 million lbs (anticipating an additional 92 million lbs). This would be 50 million lbs MORE than the widely used Objective Estimate of 2250 million lbs. Nevertheless, kudos to crop forecasters for another usefully accurate estimate that continues to prove its worth. We note with admiration the nonpareil receipts to date at 900 million lbs, reaching the number forecast by NASS back in early July, and viewed as unrealistically optimistic by many at the time.

A little bump in supply will be needed for what now has the potential to be a tight transition into 2018 crop. Using 2300 million lbs as the crop, the sold and shipped percentage of the marketable crop (less 2%) now stands at 74%. This is well ahead of the typical end December position (compare to 69% last year and 61% the year before). We also remind that what is left unsold is going to be a little more difficult to piece together than usual as handlers struggle with a higher than usual insect damage season other crop aberrations (reports of high doubles are rampant).

Over the past month we have seen prices mostly range-bound, but with a very dry start to the storm season and strong demand lending a firm tone to the market. Standards have crept slowly higher, adding about 5 cents over the month and were seen earlier this week around $2.40 per lb. Similar dynamics have been seen in other items with Cal SSR 27/30 seen recently near $2.55 per lb, NPS 27/30 near $3.25 per lb. Blanched sliced and slivered continued in the $3.20 to $3.35 per lb range depending on quality and seller motivation.

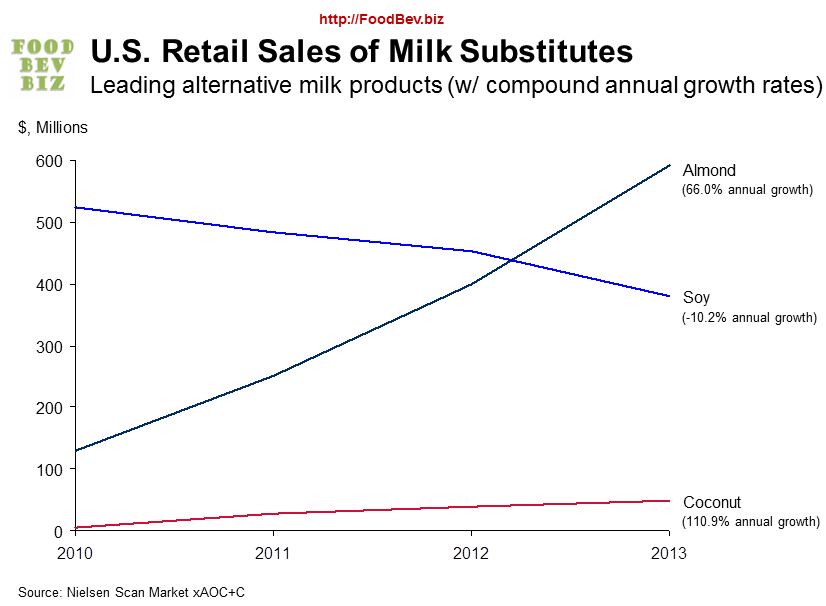

We have now seen three straight months of record breaking shipments, underscoring that almonds are in strong demand both as a healthy snack nut and as an ingredient starring in explosive new categories focused on vegetable fats and proteins. The trend is clear. Although the little bump in the 2017 crop size idea is a relief, it is not enough to change the picture of well sold sellers and buyers enjoying affordable pricing for a commodity in strong demand. A weak dollar is also helping. Consequently, we anticipate that a stable to firm pricing environment is likely continue as long as shipments hold – and with strong commitments this is more likely than not.

Within a few weeks we will enter the silly season. Bloom will be closely watched as will rain and snow totals as we progress through January and February. The additional 100,000 bearing acres coming on line in 2018 is well known and anticipated. With strong shipments confirming that current prices are working to move big crops (indeed shipments might even have been stronger if better grades and inshell were more readily available) we do not expect that favorable weather over the next couple of months will have a significant downside impact. Conversely, we see more potential for upside should a dry, warm winter threaten 2018 yields.

Kind Regards,

Jonathan Meyer

CEO

Treehouse California Almonds, LLC.

Stay tuned for the release of significant almond industry information, such as almond crop estimates and acreage reports. You’ll also find Almond Board shipping reports and related analysis from the Treehouse Almonds Leadership Team.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more