Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsNews

California handlers again surpassed expectations by shipping 219.4 million lbs in May, up 42% from shipments of 153.9 million lbs in May a year ago. With only two months to go in in the season, total shipments date now stands at 2,448 million lbs, up 21.4% versus shipments in the first ten months last season.

Domestic shipments were reassuringly steady. While the 69.9 million lbs of domestic shipments compares well (up 22%) versus May last year, they are about on par with domestic shipments over the past four months. The comparison with last year can be misleading as initial covid “pantry stocking” boosted the March and April numbers, with May shrinking back as shelves filled up. The domestic season-to-date figure is more informative, up 3.8% versus a year ago. We expect that June and July shipments will be good (the commitments are there) and domestic shipments should end up a respectable 5% or so.

May exports of 149.5 million lb were up a phenomenal 55% versus a year ago, bringing season to date export shipments 30% above last year. Over the past several months gains have been heavily reliant on massive inshell shipments. Indeed, season to date inshell shipments of 434 million lbs are up 134 million lbs (46%) versus last year. May shipments reveal that inshell is drying up in California. May inshell exports of 17.8 million lbs are only up 15%, with India taking the lion’s share but sharply slowing from the growth pace seen earlier in the season. Kernel exports took up the slack in May, increasing by 49.4 million to 121.4 million lbs (up 68%). Western European shipments continue to impress, increasing by 35% in May to 52.3 million lbs as manufacturers in Spain, Italy and Netherlands pulled heavily. Middle East shipments were up 117% to 21.4 million lbs. Morocco continues its run, adding 11.2 million lbs in May with its season to date total of 56.3 million lbs elevating it to a major player. Last but not least of the mentions, Chinese May shipments of 8.9 million lbs were up over 200% versus a year ago and showed a willingness to buy mostly kernel.

Commitments are not as exciting as shipments and reflects the disconnect between buyers and sellers regarding the surprisingly large Subjective Estimate of 3.2 billion lbs released about a month ago (up 3.2% versus the 2020 crop of 3102 million lbs). Sellers have held back from offers not expecting that a back-to-back bumper crop can be achieved. Buyers remember well the early skepticism a year ago regarding the subjective forecast (3.0 billion lbs forecast and final 2020 crop even higher at 3.1 billion) and for the most part have shown patience. New crop commitments were reported for the first time, showing commitments of 231 million lbs, down from 286 million lbs at this time a year ago and reflecting a sold position of 7.4% of the forecast 2021 crop. Over the past four seasons that May new crop commitments have been reported, this number has ranged between 3.6% and 9.5%. So, a slower start to sales than last season, but not dramatic.

Current crop commitments were reported at 607 million lbs, a notable drop from last month as current crop sales (103 million lbs, with only 18 million lbs of new domestic sales) likewise appeared to be constrained by the impasse between buyer and sellers.

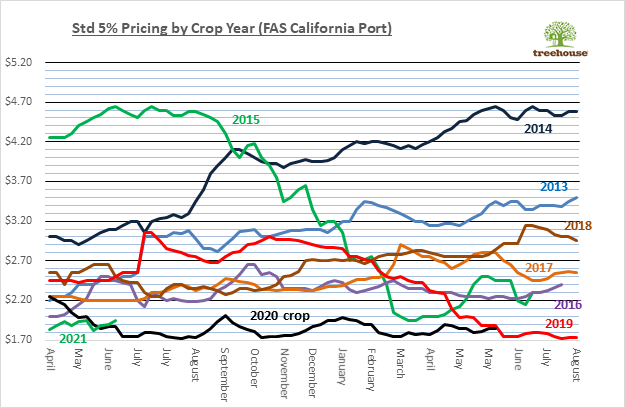

Over the past month, despite the surprising Subjective the overall market has been surprisingly stable. The initial reaction from the trade was to drop currently crop standards to close to $1.75 per lb FAS and new crop to $1.85 or so. Finding very little traction with sellers, levels quickly rebounded to ranges seen prior to the estimate and for the past weeks have been close to $1.85 for current crop and $1.95 per lb for new crop. Significant premiums for large nonpareil have remained intact for both current and new crop. Demand for inshell has been notable over the past month. Current crop inshell is about depleted, with the rare container trading most recently near $2.00 per lb. Strong interest for new crop inshell has pushed levels from $1.70 per lb two weeks ago to over $1.80 over the past few days. The strong inshell premium has discouraged sellers from selling kernel, which has not enjoyed the same demand.

To sum it up, another very good shipping report for the California industry. While sales may not have been as robust as shipments, this is not surprising given the uncertainly generated by the crop outlook. Both buyers and sellers may now choose to wait for the Objective estimate on July 12th before modifying their 2021 crop opinions, but certainly the sellers are in the driving seat. It is worth noting some differences versus a year ago when the market was likewise facing a record crop.

1. California will have shipped 500 million ADDITIONAL pounds this past season (up over 20%) — a huge confidence booster for sellers

2. Covid uncertainties are now essentially cleared up. While this may not result in more consumption, the fear of lost consumption is eliminated

3. A more positive environment for US trade in general and particularly with China

4. Drought in California will continue garner more attention, with focus on water costs and availability

We are likely to see sellers remain firm over the next month, with more buyers looking to hedge at least some of their risk before the July 12th Objective sets the tone for the 3rd quarter. The chart of standard 5 pricing below might be a helpful reminder of relative levels as we contemplate the 2021 season.

Stay tuned for the release of significant almond industry information, such as almond crop estimates and acreage reports. You’ll also find Almond Board shipping reports and related analysis from the Treehouse Almonds Leadership Team.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more