Empty cart

Oh no! It appears your cart is empty. Add some almonds to your daily regime with the Treehouse products.

All Blog PostsNews

California shippers unleashed their October lions, shipping an all-time monthly record 309.7 million lbs, up 16.6% over October shipments of 265.5 million lbs a year ago.

Both domestic (up 18%) and export shipments (up 16 %) posted strong gains. Exports, despite vessel and port challenges increased by 32.9 million lbs to 235.9 million lbs for the month and were primarily buoyed by Indian (up 16.0 million lbs to 41.1 million lbs) and Chinese/Vietnamese shipments (up 14.2 million lbs to 43.7 million lbs). Other export destinations were a mixed bag for October — Western Europe and Middle East slightly off, while Central and South American volumes, though small, showing good strength.

Shipments for first 3 months of the season are now ahead by 25.3% (154.2 million lbs) over last season (763.7 million versus 609.5 million lbs). This is a phenomenal start to an exceptional season where the the total supply has increased by 570 million lbs (440 million lbs of additional crop and 130 million lbs of additional carry over) versus the season before. California shippers have their work cut out to avoid an excessively heavy carryover into the 2021 crop. For argument sake we would put an upper level of California carryover tolerance at around 700 million lbs. To come in under this level shipments will need to increase by 13.5% or 320 million lbs for the season. Low prices are working and after three months California is about half-way there.

Receipts increased by 758 million lbs in October, with end October numbers totaling 1,811 million lbs for the season. This is 220 million lbs ahead of receipts at the same time a year ago. It is far too early to make any crop projection from this number. However, we can point to hullers working at capacity; 780 million lbs the previous month (September) being the all-time monthly record. Harvest operations, hampered a little by smoke last month, but no rain to speak of, are now wrapped up state-wide and everything not reported so far is sitting in stockpiles at the hullers. It is about this time of the year that stockpile surveys make the rounds and crop ideas are argued. This season the clamor appears to be muted and it appears that 3 billion lbs is pretty much accepted.

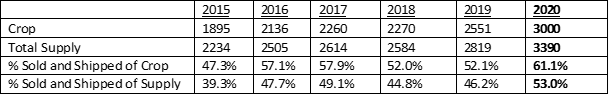

Commitments continue to hold up well at 1033 million lbs versus 694 million lbs at the end of October a year ago. There was, and continues to be, some concern that buying had come in earlier than usual this year and would slow down later in the season and the new October sales number of 250 million lbs shows continued buying strength. The extremely strong commitments combined with the extremely strong shipment numbers put California in a higher committed and shipped position than we have seen since 2007. The table below showing end October sold and shipped as percentage of both the crop and the total supply puts the past the past 5 years in perspective.

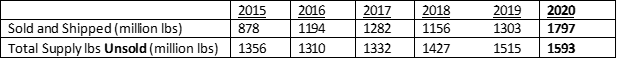

By either measure California is well sold and shipped on a percentage basis. It needs to be as there are a lot of almonds still to be sold. This next table shows end October actual lbs still to be sold, which puts a little different flavor on it, but by no means a tall order if demand at these low prices continues to fire.

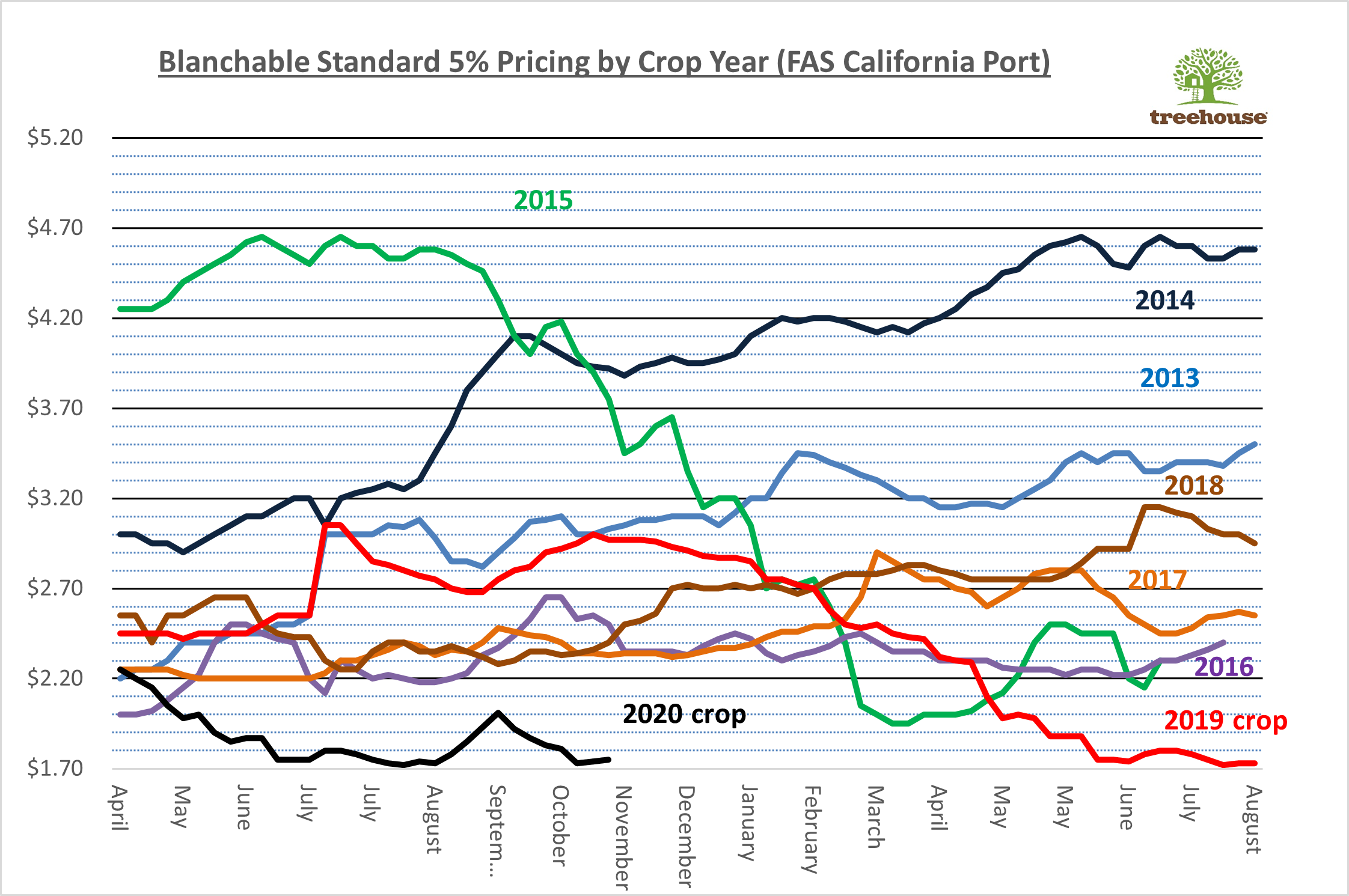

Under consistent selling pressure, prices over the past month have eroded slowly. Standards, which last month were seen in the $1.80 to $1.85 per lb were most recently seen closer to $1.75 per lb. Nonpareil values have seen a harder hit, particularly for the plentifully supplied 27/30 and smaller, now seen in the $1.85 to $1.90 per lb range. Nonpareil inshell buyers, always with an eye on small kernel levels, have been cautious with levels slipping about 5 cents and currently near $1.45 per lb FAS California.

A seasonal chart showing standard 5 pricing gives a perspective just how cheap almonds prices are today. Also interesting to note the end October inflection point in 2019 pricing as the market began to realize that the 2019 crop was larger than previously projected (by 350 million lbs!) and prices adjusted to get it moved out.

October is a crucial shipping month for California and there is nothing here that disappoints. Though there is still a way to go, the season looks increasingly manageable. Low prices have brought us to this point (with a nod to a healthy product, new markets and uses and so on). Almonds of all the tree nuts perhaps show the most price elasticity, uncovering surprising demand when prices drop. Strong commitments give us great visibility for strong shipments over the next 3 months. In a couple months we will know the actual crop and have a further feel for sales pace. Perhaps it is too early to call for higher prices quite yet, but certainly it looks like a bottom is in place.

Stay tuned for the release of significant almond industry information, such as almond crop estimates and acreage reports. You’ll also find Almond Board shipping reports and related analysis from the Treehouse Almonds Leadership Team.

Be in the loop for vital news about the California almond market.

Enjoy 10% off when you order 6 or more